Mobile credit card processing offers convenience and flexibility for businesses of all sizes.

Whether you opt for PayAnywhere or a cellular terminal with a receipt printer, the ability to accept cash and credit card payments on the go can streamline your operations and improve customer satisfaction.

With the option to swipe or key in various card types, including Visa, MasterCard, American Express, Discover, and even PayPal, you can cater to a wide range of customers while enjoying competitive rates.

It’s a smart choice that empowers your business to accept payments anytime, anywhere.

Mobile credit card processing offers numerous benefits for businesses, including flexibility, convenience, and accessibility. Whether you choose PayAnywhere or a cellular terminal with a receipt printer, both options provide advantages for accepting cash and credit card payments on the go. Here are some reasons why mobile credit card processing is considered a smart choice:

Flexibility: Mobile credit card processing allows businesses to accept payments anywhere with cellular or internet connectivity, providing flexibility for on-the-go sales, trade shows, events, and deliveries.

Convenience: With mobile credit card processing, customers can pay using their preferred payment method, whether it’s Visa, MasterCard, American Express, Discover, or PayPal, enhancing convenience and satisfaction.

Low Rates: Many mobile credit card processing services offer competitive rates for processing transactions, helping businesses save on fees compared to traditional payment processing methods.

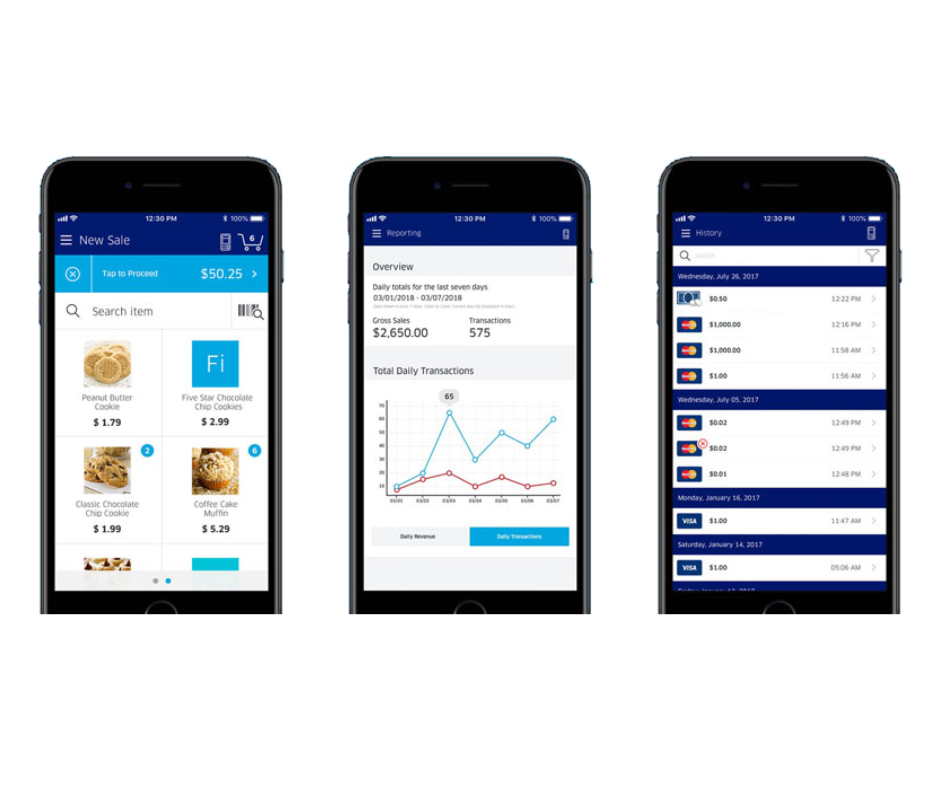

Ease of Use: Mobile credit card processing solutions typically offer user-friendly interfaces and intuitive apps, making it easy for businesses to swipe or key in card payments and manage transactions on smartphones or tablets.

Increased Sales: By accepting credit card payments on the go, businesses can capture sales opportunities they might otherwise miss, leading to increased revenue and improved cash flow.

Enhanced Security: Mobile credit card processing solutions often come with advanced security features such as encryption and tokenization, helping to protect sensitive payment data and reduce the risk of fraud.

Real-Time Reporting: Many mobile credit card processing apps provide real-time reporting and analytics, allowing businesses to track sales, monitor inventory, and gain valuable insights into customer behavior.

Overall, whether you choose PayAnywhere or a cellular terminal with a receipt printer, mobile credit card processing offers a convenient, cost-effective, and efficient way for businesses to accept payments on the go, making it a smart choice for modern commerce.

Fast Settlement: Transactions processed through mobile credit card processing are often settled quickly, with funds deposited into the merchant’s account within a short timeframe, typically within 1-2 business days.

Real-Time Reporting: Mobile credit card processing apps offer real-time reporting and transaction tracking, enabling businesses to monitor sales activity and reconcile payments swiftly.

Reduced Wait Times: With mobile credit card processing, there’s no need to wait for customers to visit a physical location or mail in payments. Businesses can accept payments on the spot, reducing wait times and streamlining the payment process.

Efficient Checkout Experience: Mobile credit card processing facilitates a seamless checkout experience for customers, allowing them to pay quickly and securely using their preferred payment method.

Expanded Customer Base: Accepting credit card payments on the go attracts customers who prefer card payments, broadening your market reach and increasing sales potential.

Higher Sales Volume: The ability to process payments anywhere, from trade shows to customer locations, captures more sales opportunities, boosting overall sales volume.

Faster Transaction Processing: Quick processing times mean serving more customers efficiently, leading to increased daily transaction volumes.

Upselling Opportunities: Integrated tools like inventory and customer relationship management aid in tracking customer preferences and upselling, enhancing transaction values.

Competitive Advantage: Providing mobile payment options meets customer expectations for convenience, giving your business a competitive advantage.

Cost Savings: Despite initial setup costs, the long-term increase in sales and efficient processing rates can lead to significant cost savings.

Convenience: Accept payments anywhere, anytime, offering customers their preferred payment methods, including credit, debit, and mobile wallets like Apple Pay or Google Pay.

Flexibility: Accommodate various payment methods, from swiping and tapping to manual entry, catering to diverse customer preferences.

Efficiency: Speed up transactions, reduce wait times, and minimize manual cash handling, improving service for both businesses and customers.

Security: Utilize encryption and tokenization to secure payment information, building customer trust in the transaction process.

Real-Time Authorization: Offer immediate transaction confirmation, enhancing the checkout experience and reducing declined transactions.

Integration with Point-of-Sale Systems: Seamlessly integrate with existing POS systems for a cohesive and efficient payment process.

Our mobile credit card processing solutions are suitable for a wide range of industries such as:

And many others!

Our Premium Mobile Commerce Solutions cater to the evolving needs of mobile shoppers, offering advanced tools for a seamless and secure shopping experience. Designed for ease of use, our solutions feature intuitive interfaces and robust security measures, ensuring safe and efficient transactions.

We support a wide range of payment methods, including credit cards and digital wallets, facilitating convenience for a diverse customer base. These solutions integrate smoothly with existing e-commerce platforms, enhancing operational efficiency and customer satisfaction, ultimately driving increased sales and loyalty for your business.

Our mobile payment solutions enable businesses to process transactions directly on mobile devices, offering the flexibility to conduct business anywhere. These user-friendly solutions are ideal for on-the-go transactions and in-store efficiency, enhancing both operational effectiveness and customer experience.

Our mobile POS terminals are compact and integrate seamlessly with existing systems, supporting various payment forms including credit and debit cards. Ideal for businesses that operate beyond traditional settings, these terminals facilitate immediate, on-site transactions.

In addition to mobile POS terminals, we offer chip card reader plugins that provide an extra layer of security and convenience. These plugins are designed to work with a wide range of mobile devices, making them a versatile option for businesses of all sizes. They are particularly useful for securely processing chip-enabled cards, which are becoming increasingly common. By incorporating a chip card reader plugin into your mobile payment setup, you can ensure that your business stays ahead of the curve in payment technology and security standards.

Our comprehensive mobile payment solutions are designed to cater to the modern needs of businesses and customers alike. We offer a variety of innovative payment methods that are not only convenient but also enhance the overall transaction experience. These solutions are tailored to meet the diverse preferences of your customers, ensuring that your business stays ahead in the competitive digital landscape.

Quick Response (QR) Codes offer a fast and contactless payment option. Customers can simply scan the QR code with their smartphone to complete a transaction, making it a convenient choice for both in-person and remote payments.

This feature allows customers to make payments via text message, adding a layer of convenience for those who prefer mobile-based transactions. It’s a simple, secure, and quick way to process payments, ideal for businesses that require on-the-go payment solutions.

We provide the option to send payment requests through email links. Customers can pay by clicking on the link, which takes them to a secure payment portal. This method is particularly useful for businesses that invoice clients or sell through email marketing.

Leveraging the power of social media platforms, our solutions enable businesses to accept payments directly through social media channels. This method taps into the vast user base of social platforms, offering a seamless payment experience within the social media ecosystem.

Emily brings a wealth of financial experience and analytical skills to the table. She specializes in helping businesses optimize their merchant services costs and identify opportunities for improvement. When she's not working, Emily enjoys yoga, reading, and volunteering for animal shelters.

View all posts